Bitcoin, and the cryptocurrency market as a whole, is often compared to the dot-com bubble that burst in the early 2000s. Analysts draw parallels and analogies that would help predict a rise or fall in the price of cryptocurrencies.

Is Bitcoin a Bubble? What is it Backed By? Read our easy understandable analysis.

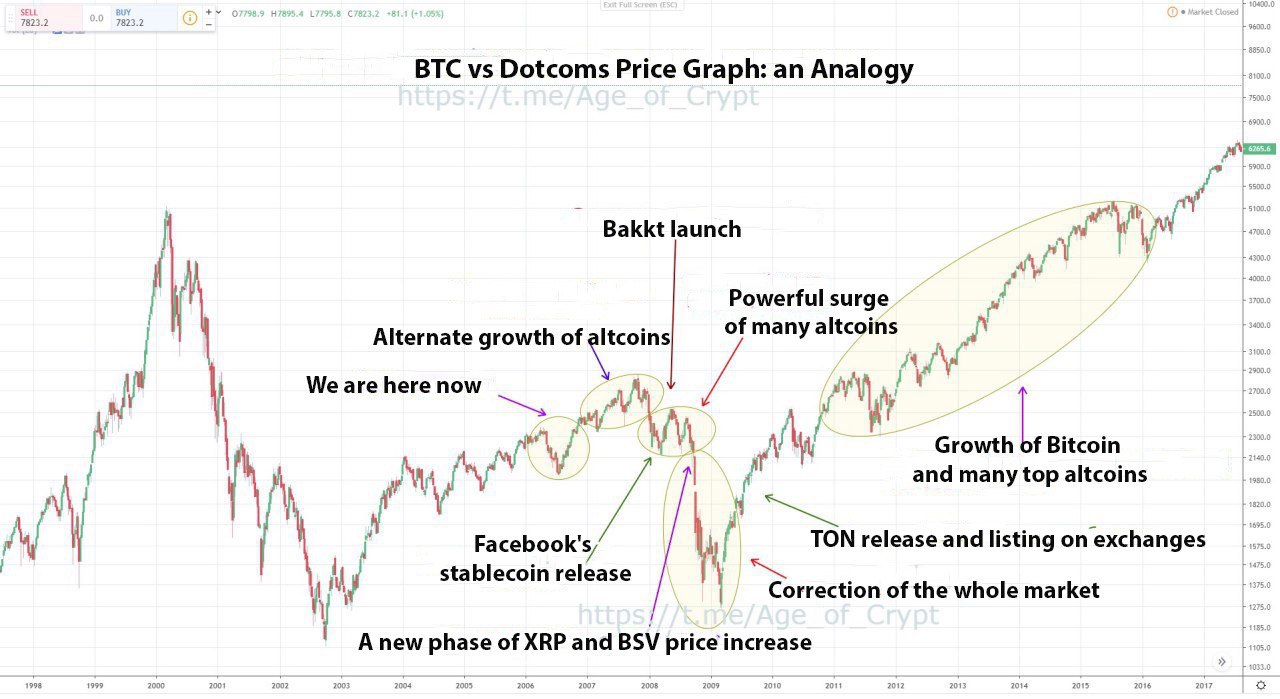

We would like to share a graph, supposedly created by the authors of a Russian Telegram channel https://t.me/Age_of_Crypt. It was generated by overlaying graph of bitcoin capitalization and that of dot-com market. Look at the image below.

If we consider this analogy to be reliable, then in 2019 one should not wait for not only the repetition of the peaks of December 2017, but also the breaking of resistance mark at around $12,000. This is to some extent consistent with a realistic Bitcoin price prediction 2019-2020. But what about the upcoming [potential] fall to $4k?

On the one hand, historical parallels can not always be considered quite reasonable method of market analysis. On the other hand, in May, many users expressed an opinion about a possible rollback of the BTC price. In any case, there is no reason for distress, because according to the graph above, bull run scenario is predetermined. It seems that the author considers the launch of the TON blockchain platform to be the main growth trigger. However, the release of its test version did not really affect the market.

The proposed analysis is worth the attention. It confirms our point of view about the serious growth of the market in 2020.

What is your opinion on this approach?