Today, Bitmex crypto exchange has published a report created with the help of TokenAnalyst service, which contains information about ETH holdings in ICO accounts. Let’s recall that at the end of August this year, CEO Bitmex Arthur Hayes called Ether “a double digit shitcoin”. However, the recent report looks more objective and reasonable with no hype claims.

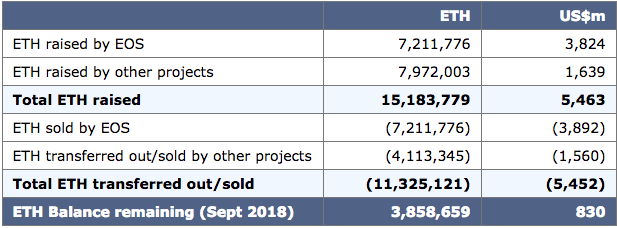

Here’s what the report shows:

As you can see, 3,8 mln Ether coins are still holding by the projects. According to a commentary to the report, despite 85 per cent reduction in the ETH price (from $1400 peak) ICO project have received $727 million gains due to selling the crypto before recent price decline.

In addition, the report has revealed that Ethereum coins that are still held by the projects allow to gain profits even at the current price $230 rather than losses.

Bitmex experts have concluded that ICO treasure accounts provide much lower rate of exposure the ETH cost than many folks may think. So we think it means that recent Ethereum price fluctuations (which have allowed Ripple to take 2nd place by market cap for a while) have been caused primarily by whales’ manipulations and ordinary people’s “panic sells” rather than by selling off ICO treasures.

We do not know for sure why Bitmex crypto exchange has made such a report. Probably it is just a native advertising of tokenanalyst.io. Or probably it is just a way to draw more users’ attention to the exchange and Ether trading. Anyway, the report is of high didactic value and allows for better understanding the situation with ETH price.