Since going public, SoFi Technologies (SoFi) stock has garnered significant interest from investors. As a trailblazing fintech firm providing a diverse array of financial products and services, SoFi is perceived as a possible catalyst for change in the financial sector. The growing demand for fintech solutions has piqued the curiosity of many investors who want to learn about SoFi’s stock price and future performance. This article offers an in-depth analysis of SoFi, examines factors that impact its stock price, and delves into a range of predictions from experts and social media platforms.

Contents

All you need to know about SoFi and its stocks

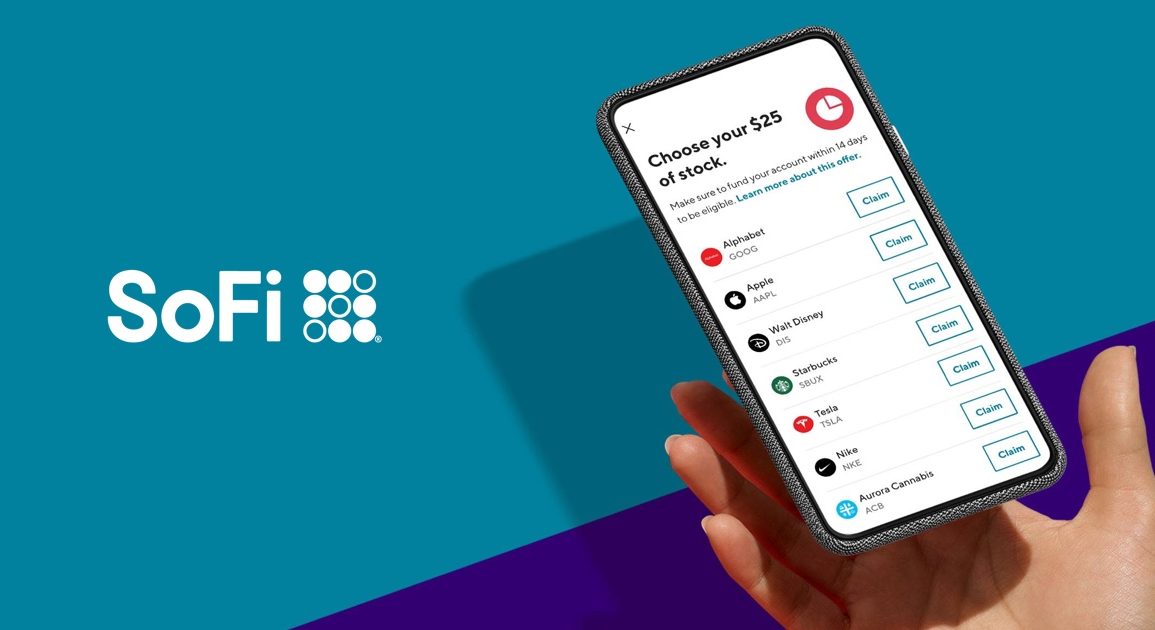

SoFi Technologies, Inc. is an American financial technology company founded in 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. The company’s primary mission is to simplify personal finance and empower its users to achieve financial independence through a suite of innovative financial products and services. SoFi’s offerings include student loan refinancing, personal loans, mortgages, investing, insurance, and a digital banking platform called SoFi Money.

In June 2021, SoFi went public through a special purpose acquisition company (SPAC) merger with Social Capital Hedosophia Holdings Corp. V, a blank-check firm led by venture capitalist Chamath Palihapitiya. The stock, which trades under the ticker symbol “SOFI,” has since become a popular choice among investors interested in the fintech sector.

Trading SoFi Stock and How to Buy It

SoFi stock is traded on the NASDAQ stock exchange, a well-known electronic marketplace for buying and selling stocks. The NASDAQ is renowned for hosting technology and innovation-focused companies like Apple, Microsoft, and Amazon. To buy or sell SoFi shares, you can use a brokerage account or an online trading platform that supports NASDAQ-listed stocks.

Factors Influencing SoFi Stock Price

Several factors can influence the price of SoFi stock. Some of these factors include:

- Market sentiment: Investor sentiment towards the fintech industry and SoFi’s growth prospects can significantly impact the stock price. Positive sentiment can lead to increased demand and a higher stock price.

- Company performance: SoFi’s financial performance, such as revenue, profit margins, and user growth, can directly impact the stock price. Positive earnings reports and user growth can boost investor confidence, leading to a rise in the stock price.

- Regulatory environment: Changes in financial regulations can affect SoFi’s operations and its ability to offer certain products and services. Regulatory changes can either positively or negatively impact the stock price, depending on the nature of the change.

- Competition: The fintech sector is highly competitive, with established financial institutions and startups vying for market share. SoFi’s ability to maintain a competitive edge in terms of technology, user experience, and product offerings can influence its stock price.

- External factors: Global events, such as economic downturns or changes in interest rates, can indirectly influence SoFi’s stock price by affecting overall market conditions.

SoFi Stock Price Forecasts 2030-2050

There is a wide range of opinions and predictions regarding SoFi’s stock price on various internet platforms and social media. Some experts and analysts are optimistic about the company’s growth prospects and believe that SoFi can potentially become a leading player in the fintech market. They argue that the company’s innovative products, strong user base, and expanding product portfolio could drive significant growth in the coming years.

On the other hand, some investors and analysts are more cautious in their outlook. They express concerns about the company’s current valuation, competition from established financial institutions, and potential regulatory hurdles.

Pros and Cons of Buying SoFi Stock

Before investing in SoFi stock, it’s important to weigh the potential benefits and drawbacks. Here are some pros and cons to consider:

Pros:

- Disruptive potential: SoFi’s innovative approach to personal finance has the potential to disrupt traditional financial institutions and reshape the industry, which could lead to significant growth opportunities.

- Diversified product offerings: SoFi’s wide range of financial products and services can attract users seeking a one-stop-shop for their financial needs, driving user growth and revenue.

- Strong user base: SoFi has a growing user base, which can contribute to increasing revenue and help the company expand its market share.

- Scalable business model: SoFi’s digital-first approach allows for scalability and cost efficiency, which can drive long-term profitability.

Cons:

- High valuation: Some investors and analysts have expressed concerns about SoFi’s current valuation, which may be perceived as overvalued given the competitive landscape and potential risks.

- Competition: The fintech industry is highly competitive, and SoFi faces strong competition from both established financial institutions and emerging startups.

- Regulatory risks: Changes in financial regulations can impact SoFi’s operations and product offerings, potentially affecting the stock price negatively.

- Market volatility: As with any stock, SoFi’s share price is subject to market fluctuations and can be influenced by external factors beyond the company’s control.

Conclusion

Investing in SoFi stock comes with both possible gains and hazards for investors. The company’s capacity for disruption and its varied range of products have drawn considerable interest, but factors such as competitive pressures, elevated valuation, and regulatory uncertainties should be taken into account before deciding to invest.

It is essential to keep in mind that stock trading inherently involves risks, and success in any investment is never guaranteed. Be sure to perform extensive research, seek advice from a financial professional, and assess your ability to handle risk before choosing to invest in any stock, SoFi included.