On 16 October 2019, Binance announced Kava token as the 10th crypto-asset to be launched on the Binance Launchpad in 2019, joining the many projects that launched an Initial Exchange Offering (IEO) on the Binance Platform. About $3 million worth of BNB was raised. The amount was generated from the sale of 6.52 million of Kava tokens, which was 6.52% of the total supply. After the project and the airdrop, the digital asset gained popularity among many of its investors. In 2021, they were able to earn millions of dollars, but in the fall of 2022, the token returned to its initial value. This makes the Kava holders nervous. Should we expect a second wave of profits in 2023, or has the project completely exhausted itself?

Contents

Why will Kava Token increase in value in 2023?

KAVA Token has confirmed its status as a Bitcoin dependent coin. This project was very profitable, but a deep correction emptied the pockets of many investors. We recommend not to bury this cryptocurrency. The ecosystem continues its work, and the underlying ideas of the cross-chain DeFi lending platform are still relevant and innovative. We associate the first stage of growth with warming in the entire market. In this case, the price will be able to confidently gain a foothold above $1 per token and again interest buyers.

A strong price drop makes KAVA an interesting investment. There is every chance that this coin will become an illustration of the words of Warren Buffett “Buy when everyone is selling”. It is the short market sentiment that creates good prospects for a rebound.

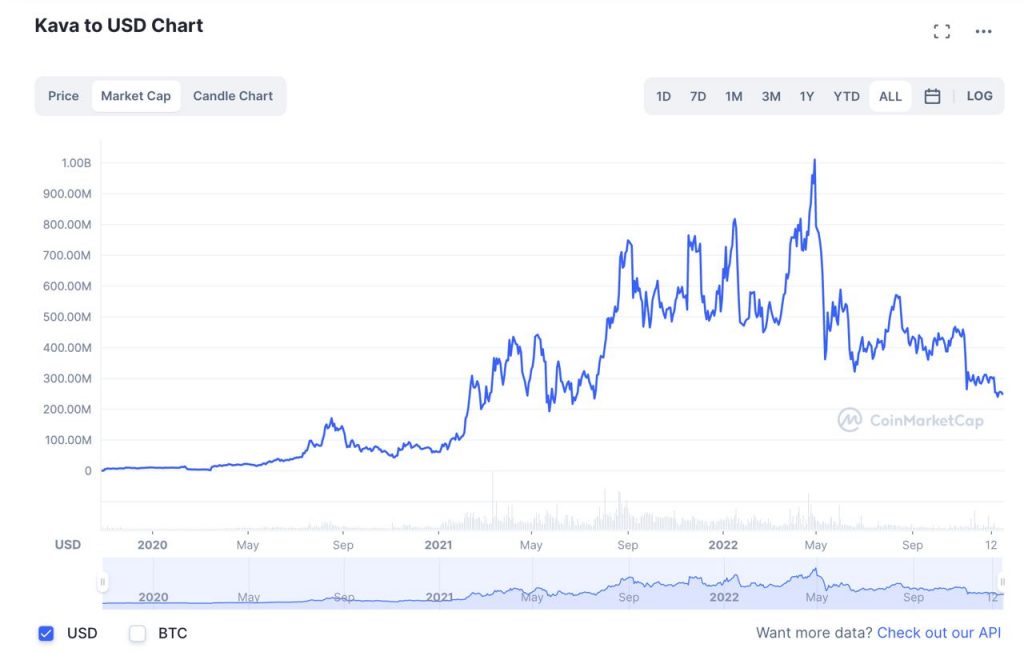

However, we have no illusions about future growth. You may have noticed that we do not present fundamental arguments in favor of pampa KAVA. This is primarily due to the fact that the buyback program launched back in 2020 did not work properly. The number of tokens continues to grow. Take a look at the market capitalization chart:

In simple words, the coin has become heavier. To make a 100% pump, it now need to accumulate about $250 million. In 2020, only $50 million was enough for this. Now the project needs richer investors.

Is additional emission a problem? Of course not. However, it must be taken into account when predicting the price. KAVA is no longer the young project with a very small capitalization that it once was. It’s time to put aside the dreams of a quick 1000% profit.

Kava Team: Who Is Working to Make the Project Profitable?

The Kava team is comprised of experienced professionals in the fields of blockchain, finance, and software development. Some key members of the team include:

- Brian Kerr – Co-founder and CEO: Brian Kerr is a serial entrepreneur with experience in gaming, digital marketing, and blockchain technology. Before founding Kava, he co-founded Fnatic Gear, an eSports hardware company, and worked as an advisor for various blockchain projects.

- Scott Stuart – Co-founder and Product Manager: Scott Stuart is an experienced product manager who has worked on various blockchain projects. He has a background in finance and has helped design and implement the Kava platform’s financial services.

- Ruaridh O’Donnell – Co-founder and Blockchain Lead: Ruaridh O’Donnell is an experienced software engineer and blockchain developer. He has worked on a number of blockchain projects, including Tendermint and Cosmos SDK, which form the foundation of the Kava platform.

- Aaron Choi – VP of Business Development: Aaron Choi has experience in business development and partnerships within the blockchain industry. His role at Kava involves forging strategic partnerships and expanding the platform’s reach in the DeFi space.

2023 Kava Token Price Predictions

Basic technical analysis of support and resistance levels indicates that the situation with KAVA is not as bad as it might seem. The coin still has very old support in the area of $0.45 per token. It is this price that can be considered for profitable purchases with a short stop loss.

No need to set fantastic goals. The closest level the coin can touch is $1.5. Before that, you need to confidently gain a foothold above the psychological mark of $1, which we wrote about in the last section.

If you bought KAVA for about 50 cents, then in 2023 your profit-taking zone could be $2.8-2.9. If the price reaches this zone, then investors will be able to get at least 300% profit. Please note that there are no guarantees of such a development of events. You must consider all risks. We are modeling a positive scenario. But even with such a positive, we would not talk about prices above $ 3. The level of 2.8-2.9 dollars is too strong to overcome it quickly. If the market conjuncture points to further market growth, then you can always re-enter a trade either on breaking through an important level or after a slight correction.

Price Predictions Overview

- WalletInvestor: WalletInvestor is a popular platform that provides technical analysis-based predictions for various cryptocurrencies. Their forecast for Kava Token was moderately optimistic, suggesting that the price could experience steady growth in the short to medium term. However, they did not provide a specific target for 2023 and beyond.

- DigitalCoinPrice: DigitalCoinPrice’s analysis predicted a gradual increase in the price of Kava Token over the years. According to their forecast, KAVA could have experienced consistent growth through 2023 and beyond, with no major price spikes.

- CryptoGround: CryptoGround used a machine learning algorithm to make predictions for various cryptocurrencies, including Kava Token. Their forecast suggested that KAVA could witness a slow but steady appreciation in value over the years.

- CoinArbitrageBot: CoinArbitrageBot provided predictions for KAVA based on technical analysis and historical data. Their analysis indicated a positive trend for KAVA’s price in the long term, with potential for growth in the coming years.

- Social media and online forums: Opinions on social media and online forums like Reddit and Twitter varied greatly. Some users were optimistic about Kava’s potential, particularly due to its focus on the DeFi (decentralized finance) sector and its interoperability with multiple blockchains. Others expressed concerns about the overall cryptocurrency market, potential regulatory hurdles, and competition within the DeFi space.

- CryptoExperts: Some cryptocurrency experts and analysts provided bullish outlooks for KAVA, predicting that the continued growth of the DeFi sector and the increasing adoption of Kava’s platform could positively impact KAVA’s price in the long term.

- TradingBeasts: TradingBeasts’ prediction model foresaw a range-bound movement for Kava Token, with the possibility of slow price appreciation in the coming years. Their analysis suggested that KAVA could experience moderate growth without any significant fluctuations.

![XRP Price Prediction: Ripple Short- and Long-Term Forecast [2023-2050]](https://cryptoinfobase.com/wp-content/uploads/2019/06/ripple-prediction-300x185.jpg)